American billionaires are a policy failure

I was glad to hear President Biden mention a minimum income tax rate for billionaires of 25% in his recent State of the Union address. Honestly, I don't think it goes far enough, but I wanted to write down some reasons why I think it's a good idea, in case anyone reading this was on the fence about it.

💰 A billion is a really big number

The first thing to realize is just how big a number a billion of anything is. I think we all know that it's 1,000 times a million, and sure, if we're talking dollars, that sounds like a lot, but most people don't realize it's so much money it's hard to truly imagine.

My favorite analogy is this: what if you started saving up $100 per day, every day into a savings account. One hundred bucks a day is an easy to grasp number, and you could imagine a person with a white collar job making 30 or 40 dollars an hour living on as little as possible you could conceivably save up half a day's pay, every day. If you could accomplish this every single day (ignoring any interest rate gains or time off), it would take you about 27 years to get to one million dollars. That's kind of an average working person's time in the workforce and these numbers make sense in our heads, right? Not easy, but possible.

For one billion, that means saving that $100/day would take twenty seven thousand years to reach one billion, which is beyond pretty much all recorded human history.

It's a ludicrously large number.

🚀 The concept of escape velocity

Here's another way to look at it: let's talk about a concept called escape velocity. In space travel, that's how much thrust you need to escape a planet's gravity. A friend used the same concept to describe high money earning as: the amount of money that grows so quickly from interest alone that you can't spend it faster than it continues to accumulate. When you hit that point, you're basically at "escape velocity" and never need to worry about money again in your life. Some people also call this level of wealth "fuck you money" or the amount of money you'd need to be able to never need anything from anyone ever again.

Numbers change with inflation, but I think a good back-of-the-envelope number for 2024 is somewhere between 50 and 100 million dollars. To make the math simple, let's go with $100M. It's 1/10th of a billion.

Now, imagine you had $100M in the bank. You'd conservatively accumulate anywhere from 5 to 10 million per year from interest alone most years, since such a large amount in the bank would qualify you for all sorts of high interest stuff normal investors don't get. Taxes would run 15%, so you'd get to keep 4.25M to 8.5M of gains every year.

Conservatively speaking—after US taxes—you'd accumulate several hundred thousand dollars every month, forever. And sure, at first, you could spend it. You could buy a house in each city you like on this planet. You could wear any clothing you wanted, and drive any car you dreamed of. But after you had a few houses and some cool stuff, the money firehose would still be spitting hundreds of thousands into your account every month. Your $100M would continue to grow faster than you spend it on anything you could think of.

Have you ever seen the movie Brewster's Millions?

An important aspect is that you would never even touch your $100M of cash sitting in the bank, since the interest income would be so high. You could continue like this forever, and it would grow beyond 100M over time.

I've met a handful of people with $100M+ and they indeed have several homes, go on vacation wherever they please, and live extremely comfortable lives. They often talk about their kids and grandkids in regards to their wealth and put a lot of energy into making sure their money becomes more of an endowment that keeps the entire family well-heeled for many generations to come.

Escape velocity means you're rich as long as you live and unless you really fuck things up, your family can be rich for hundreds of years after. This is a life completely free of any scarcity, for the rest of your life, your kids lives, and their kids lives. Buy anything you want, live anywhere you want, do anything you want and there will always be more piling up in the bank.

If we can agree everything after $100M is pretty much superfluous, maybe you can start to see why high taxes on money after a certain amount makes sense for running a larger society.

👥 How many Americans could this rule change affect?

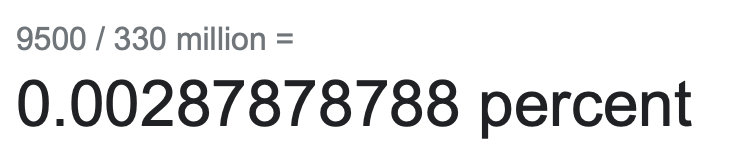

To put some actual numbers on this phenomena, there are approximately 9,500 people in America right now worth $100M or more. That's not life in the 1% or even the 0.01%. It's the top 0.003% of the country.

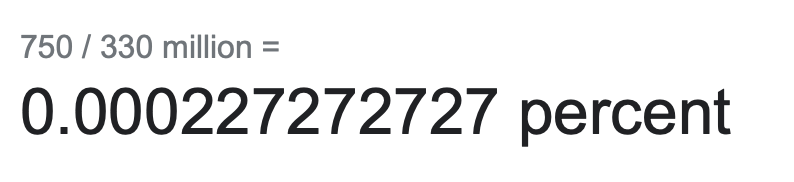

For comparison sake, there are roughly 750 Americans with more than a billion dollars net worth. You can probably name them all in an article on Bloomberg or Fortune.

Think back to what it's like having 1/10th of one billion, in the top 0.003% of earners in American society living free of scarcity. Now think about Jeff Bezos being worth 194 billion, or Musk worth 215 billion, or Zuckerberg being worth 175 billion today. These numbers are insane.

🧑⚖️ Rich people spend money on lawyers and accountants, not taxes

I've worked a lot of jobs in my life but I also know I had a great string of luck along the way that isn't available to everyone. But one thing I've realized as I've gotten access to better financial advice is that there seems to be a two-tiered system in finance. One tier is normal people paying 25-35% federal tax rates and an additional 5-15% state tax rates on all their earnings. It's why I've always assumed I would lose a third to one half of whatever annual bonus I might receive at any job, because that's the rates I get as a normal person.

Then there's the other tier, with special rich people rules. As Mitt Romney (net worth: $200M) said himself when running for president in 2012, he paid a tax rate around 14% of earnings in 2011. Capital gains run 15% and that's money you make from interest and stock sales and even Mitt has accountants doing the extra work to reduce his overall rate even further. As I've grown older I've been shocked to learn all the weird ways rich people can donate money to certain places that gets them more than the money they put in, but taken off their taxes.

🤔 Taxing the rich—isn't this just socialism or communism?!

"Rich people will stop working so hard if they're taxed too highly for being ultra-successful!" is a refrain I've heard for decades that makes no sense to me. I think a better question is asking when is enough, enough?

We can all likely agree there shouldn't be one person on earth with ten trillion dollars while the other 8 billion people struggle to get basic needs met.

I'm saying one hundred million dollars is more than any family could ever need for hundreds of years, and one billion is astronomical and beyond what any person could ever realistically spend over the course of their lifetimes (billionaires might own many companies but they rarely use their own money to buy companies, they raise capital from investors instead).

Putting a 25% tax on 750 people to benefit the 330 million other members of the American public? Maybe you can see why it's not a radical idea when middle-class people are already paying higher rates themselves.

To be clear, those affected by the rate increase would continue to be billionaires—it's just that their fortunes would grow beyond a billion at a slightly slower pace.

💸 Give it away, give it away now

I've met a couple billionaires from the tech world and thankfully, the one thing they talk about soon after they cross into the "three comma club" is how to give away their money. I'm happy that most tech bigwigs have charitable foundations. Andrew Carnegie used his empire to build libraries all across the country that I pass in every place I visit (including the town I live in). Bill Gates runs a massive foundation famously tasked with giving away his billions around the globe.

Warren Buffet is one of the richest Americans and has repeatedly said it's unjust that his assistants pay higher tax rates than he does. Back when he said it, the top 500 richest Americans only paid an average of 18% tax on their income. Raising the rate to 25% isn't that big of a stretch, but when we're talking about such large numbers, it could really improve cities, schools, services, and our collective safety net.

Sadly, it seems like Bezos and Musk aren’t in the philanthropy mood these days as they’re joining forces to try and gut the laws around labor unions.

Honestly, I don't think this mild tax hike for billionaires will happen even if Biden wins his reelection because the richest Americans have all the resources on earth ready to fight this, but it would be a small course correction to a tiny number of people that could really shift how the rest of us get to live.

Subscribe to our newsletter.

Be the first to know - subscribe today